Investment involves risk. Prices of investment products can be volatile and may become valueless. Past performance information not indicative of future performance. Investors should read in detail the offering documents and the Risk Disclosure Statement of the relevant investment products.

KGI strives to provide sustainable wealth solutions for clients, employees and society. We value long-term contributions to the sustainable development of the environment and society through effective investment strategies. Our ultimate goal is to offer a more harmonious and prosperous future, a rejuvenated physical and mental status to our investors while we have a key role to play in protecting the environment and creating a sustainable society for our next generation.

“Your investments may help shaping a healthy and vibrant planet!

We offer bespoke ESG product solutions to fulfill your investment goals and objectives, and capture the long-term growth opportunities”

How may the companies be benefited by “protecting the environment, socially responsible, and outstanding governance” in a long run?

Generally speaking, high ESG-rated companies may be relatively easier in gaining strategic relaxations from regulatory policy easing and subsidies from the government

Is ESG investment simply a craze or a long-term investment?

Historical data* shows that investing in sustainable ESG companies enjoys a better return. Relatively, the trend is more notable in the EM investments

In terms of the asset size, global ESG assets are on track to exceed US$53 trillion by 2025, representing more than a third of the projected total assets under management. #

Increase in fund assets may reflect growing investors’ attention and recognition of ESG themes, in the meantime, capital inflows may enhance value of the related assets.

* Past performance information does not represent future performance

#Source:Bloomberg Intelligence: ESG assets may hit $53 trillion by 2025, a third of global AUM , 23 February 2021

• Potential return appreciation

• Reduce portfolio risk

• Contribute to society and sustainability, as a responsible stakeholder

- Geographical and Industry Diversification

- Managed by professional fund managers

- Access to various investment themes globally

SFC-authorized unit trusts and mutual funds – ESG funds***

- BNP Energy Transition Fund

- BlackRock Sustainable Energy Fund

- AB Sustainable Global Thematic Portfolio

- Schroder ISF Global Climate Change Equity Fund

- BlackRock ESG Multi-Asset Fund

- Allianz Food Security Fund

- Ninety One Global Strategy Fund

- Allianz Global Sustainability Fund

- Neuberger Berman Short Duration High Yield Bond Fund

***Source: List of ESG Funds

- Flexibly formulate products such as underlying equities, coupon, strike and tenor

- Potential return generation and yield enhancement

- Tailor-made risk and returns structure to cater different market situations

- Swire Properties

- CLP Group

- Hang Seng Bank

- HKEX

- Power Assets

- HSBC

- AIA

US Stock

- NVIDIA

- Adobe

- Deere & Co

- Apple

- Microsoft

- 3M

- Nike

24-hour investment hotline: (852) 2878-5555 / Email: info@kgi.com

- Debut Green Inflation-linked bond for retail investors in 2022

- Hong Kong Exchanges launched Board Diversity Repository and enhance ESG Academy

- In response to the Paris Agreement, the Government announced Hong Kong’s Climate Action Plan 2030+ in 2017, setting out the decarbonization target

- As an important financial hub, green and sustainable bonds issuance arranged in HKSAR accounts of more than one-third of the total amount in Asia in 2021***

- The Chin Family Blog – ESG Information

European Union

- EU Taxonomy Article 8 was effective from Jan 2022, giving classification system to identify economic activities considered sustainable – which aims to increase the transparency in the market and mitigate the greenwashing and subsequent reputation risks

United States

- SEC proposes “Standardize Climate-Related Disclosures” which aims to provide investors with consistent and comparable information for investment decision making.

Mainland China:

- Carbon reduction starting from high emitting industries, like thermal power and cement, aiming to reach carbon peak by 2030 and carbon neutral by 2060

- Shanghai Environment and Energy Exchange set stage to launch the Country-wide carbon trade to allow companies trading carbon credits

- At current stage, there is no uniform set of standardized methodology or ESG rating to evaluate ESG investment globally and different rating agencies may have their own rating methodologies. To assess ESG investment and understand its risk-reward nature, you need to consider both financial and non-financial factors including but not limited to the overall financial performance and the ESG factors.

- An over-concentrated portfolio may affect the investment return. In today’s changing world, ESG related topics are intertwined with policy. For example, achieving carbon neutrality and addressing climate change have become key issues and goals for many countries around the world. Investors should consider taking a diversified risk-balanced approach to capture the sustainable growth opportunities in face of ESG investment.

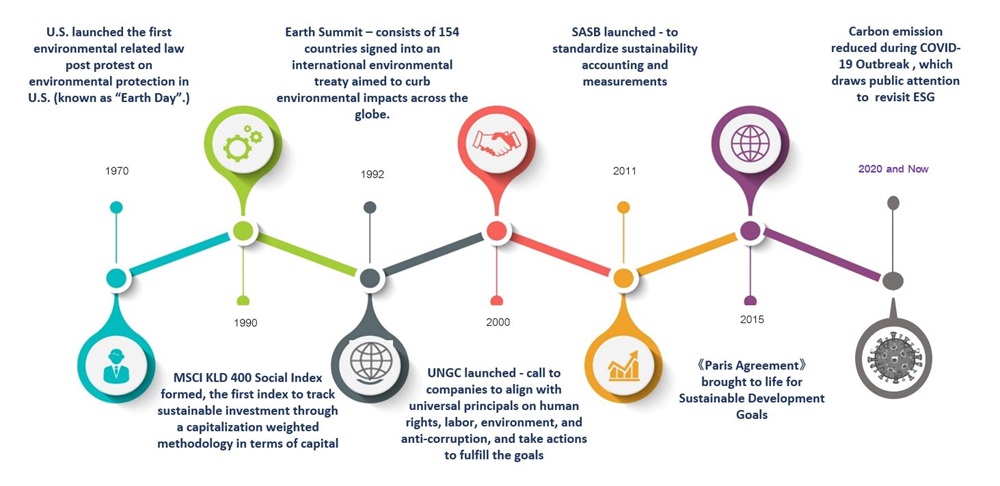

ESG consists of three pillars – namely Environmental (E), Social (S) and Governance (G).

ESG investing is considered as one of the sustainable investments, which aims to generate return in a long run, as well as risk mitigation.

Currently, there’s no uniform set of standardized measurement or criteria to evaluate ESG investment globally. Having said that, there are several scoring systems and standards from global financial corporations / rating agencies such as MSCI, Moody’s, Standards and Poor’s and Morningstars. Upon evaluation of ESG ratings of a company, investors shall take into consideration of ESG ratings from different rating providers alongside its financial performance to formulate a more objective and comprehensive investment strategy.

Traditionally investors may eliminate the companies that are not complying with the ESG concepts. Nowadays, investors are adopting more approaches and aspects to assess the ESG performance of a company which would include positive screening (Select the ESG leaders in the sector), consider corporate communications and impact investing, etc.

We provide various ESG products to align your long-term financial goals, including ESG investment funds, green bonds, sustainable bonds and structured products, etc.

You should CLICK HERE to open brokerage account with us by providing the relevant documents including risk profiling questionnaire to help us better understand your investment objectives and appetite.

All investments involve risks. The prices of securities fluctuate, sometimes dramatically. The price of a security may move up or down, and may become valueless. It is as likely that losses will be incurred rather than profit made as a result of buying and selling securities.

Prices of fund units may go up as well as down and past performance information presented is not indicative of future performance. Investors should read the relevant fund’s offering documents (including the full text of the risk factors stated therein (in particular those associated with investments in emerging markets for funds investing in emerging markets)) in detail before making any investment decision.

Bond investment is NOT equivalent to a time deposit. It is NOT protected under the Hong Kong Deposit Protection Scheme. Bondholders are exposed to a variety of risks, including but not limited to: (i) Credit risk – The issuer is responsible for payment of interest and repayment of principal of bonds. If the issuer defaults, the holder of bonds may not be able to receive interest and get back the principal. It should also be noted that credit ratings assigned by credit rating agencies do not guarantee the creditworthiness of the issuer; (ii) Liquidity risk – some bonds may not have active secondary markets and it would be difficult or impossible for investors to sell the bond before its maturity; (iii) Interest rate risk – When the interest rate rises, the price of a fixed rate bond will normally drop, and vice versa. If you want to sell your bond before it matures, you may get less than your purchase price. Do not invest in bond unless you fully understand and are willing to assume the risks associated with it. Please seek independent advice if you are unsure.

You are advised to exercise caution and undertake your own independent review, and you should seek independent professional advice before making any investment decision. You should carefully consider whether investment is suitable in light of your own risk tolerance, financial situation, investment experience, investment objectives, investment horizon and investment knowledge.

No representation or warranty is given, whether express or implied, on the accuracy, adequacy or completeness of information provided herein. In all cases, anyone proposing to rely on or use the information contained herein should independently verify and check the accuracy, completeness, reliability and suitability of the information. Simulations, past and projected performance may not necessarily be indicative of future results. Information including the figures stated herein may not necessarily have been independently verified, and such information should not be relied upon in making investment decisions. None of KGI, its affiliates or their respective directors, officers, employees and representatives will be liable for any loss or damage of any kind (whether direct, indirect or consequential losses or other economic loss of any kind) suffered or incurred by any person or entity due to any omission, error, inaccuracy, incompleteness or otherwise, or any reliance on such information. Furthermore, none of KGI, its affiliates or their respective directors, officers, employees and representatives shall be liable for the content of information provided by or quoted from third parties.

Members of the KGI group and their affiliates may provide services to any companies and affiliates of such companies mentioned herein. Members of the KGI group, their affiliates and their directors, officers, employees and representatives may from time to time have a position in any securities mentioned herein.

The information in this webpage has not been reviewed by the Securities and Futures Commission (“SFC”). The SFC takes no responsibility for the soundness of the authorized funds or investment products and does not imply that investment in them is recommended by the SFC.

“Complex product” refers to an investment product whose terms, features and risks are not reasonably likely to be understood by a retail investor because of its complex structure. Investors should exercise caution in relation to complex products. Investors may lose the entire invested amount or more than the invested amount (if applicable). For complex products for which the offering documents or information provided by the issuer have not been reviewed by the SFC, investors are advised to exercise caution in relation to the offer. For complex products described as having been authorized by the SFC, SFC authorization does not imply official recommendation and such authorization is not a recommendation or endorsement of a product nor does it guarantee the commercial merits of a product or its performance. Where past performance information is provided past performance is not indicative of future performance. Some complex products are only available to professional investors. Investors should read the offering documents and other relevant materials to understand the key nature, features and risks of a complex product and are advised to seek independent professional advice before making any investment decision and should have sufficient net worth to be able to assume the risks and bear the potential losses of trading the product.

Trading in derivative products (including but not limited to equity-linked instruments, credit-linked notes, derivative warrants and convertible securities) tracking fluctuations in the price or level of securities, bonds, money market instruments, interest rates, reference indices or other benchmark) involves risks. Changes in market conditions may cause great changes in the value of such products. As a consequence, your related exposure to price or market risk may be significantly higher in connection with a derivative product than with other non-derivative financial instruments with which you may be familiar.

Derivative products may not be suitable for you as they can be complex and carry with them substantial risk of loss. You should make investment in derivative products only after carefully assessing among other things the direction, timing, and magnitude of the potential future changes in the price or level of the underlying asset or instrument or other benchmark, as the return of any such investment may be dependent upon such changes. However, risks associated with trading in derivative products are not and should not be presumed to be predictable. Investing in certain types of derivative products may result in your having to take or make delivery of certain underlying asset or instrument at a predetermined price. In such circumstances, you will need to perform such obligation however far the market price or level of the underlying asset or instrument has moved away from the pre-determined price or level and the resulting losses to you can be substantial.

Equity Linked Instruments (ELIs) are structured products which are marketed to investors who want to earn a higher interest rate than the rate on an ordinary time deposit and accept the risk of repayment in the form of the underlying shares or losing some or all of their investment. When an investor purchases an ELI, he is indirectly writing an option on the underlying shares. If the market moves as the investor expected, he earns a fixed return from his investment which is derived mainly from the premium received on writing the option. If the market moves against the investor’s view, he may lose some or all of his investment or receive shares worth less than the initial investment. Investors may lose part or all of their investment if the price of the underlying security moves against their investment view. Investors are exposed to price movements in the underlying security and the stock market, the impact of dividends and corporate actions and counterparty risks. Investors must also be prepared to accept the risk of receiving the underlying shares or a payment less than their original investment. Investors should note that any dividend payment on the underlying security may affect its price and the payback of the

ELI at expiry due to ex-dividend pricing. Investors should also note that issuers may make adjustments to the ELI due to corporate actions on the underlying security. Investors should consult their brokers on fees and charges related to the purchase and sale of ELI and payment / delivery at expiry. The potential yields disseminated by The Stock Exchange of Hong Kong Limited have not taken fees and charges into consideration. While most ELIs offer a yield that is potentially higher than the interest on fixed deposits and traditional bonds, the return on investment is limited to the potential yield of individual ELIs.

If there is any inconsistency between the English and Chinese versions of the above Disclaimer, the English version shall prevail.